What is a Balloon Payment?

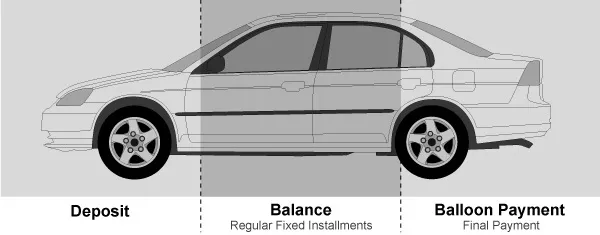

A balloon payment is a lump sum paid to the lender at the end of the loan term. By having a balloon Payment (Residual Payment) at the end of the loan term, it helps reduce the ongoing monthly payments throughout the entire loan term, which helps increase cash flow in your business.

As an example, a business owner may take a 60-month term with a 30% balloon, then at the end of the loan term they would trade in their 5-year-old car, pay the balloon with the trade in proceeds, then upgrade to a brand new car. This process allows the business owner to have a brand new car every 5 years while preserving cash flow in the business with lower vehicle or equipment repayments.

What is the Advantage of a Balloon Payment?

- Lower Monthly Payments. This is the main benefit of the balloon payment. Valuable cash flow is preserved which can be used to grow your business.

What are the Things to Consider in Choosing Balloon Payment?

- Research the online car market to confirm that your expected trade-in price for a 5-year-old car will cover the balloon payment – certain makes of cars hold their value more than others.

- Lenders will not generally let you have a balloon on an older car, as the value will not be there down the track, therefore it would be too much risk for them.

Standard Balloon structures may be as below:

- 60 month Term / 30% Balloon

- 48 Month Term / 40 % Balloon

- 36 Month term / 50% Balloon

Some lenders will allow higher balloons for prestige cars that hold their value or lower balloons for cars they think will not hold their value as well. Also, the borrower’s asset position can also affect the balloon allowed.

Get in Touch with CarFund

To find out more about balloon payments, feel free to talk to contact us. We have access to a wide range of lenders and we will customise your car finance based on your requirements and financial position.

We specialise in Low Doc Car Loans, No Doc Car Loans, Low Doc Truck Loans, No Doc Trucks Loans and No Doc Equipment finance.

Please visit our Car Loan Calculator or Truck Finance Calculator to get a quote emailed to in 30 mins.

We can arrange Low Doc Car Finance up to $150,000 with no financials and Low Doc Truck Finance up to $500,000 with no financials.

If you have specific questions about your unique situation, please contact us either by using our Quick Enquiry Form, Email or Phone.

Alternatively, just complete our 5 Minute application form or Car Loan Calculator form.